tudor investment machine learning | Paul Tudor Jones, Tudor Investment Holdings tudor investment machine learning Veteran manager backs machine learning with investments in CargoMetrics and Numerai. For a more casual look, you can complete your look with sneakers like the Alexander McQueen Oversized Ivory Black. . StockX. Access the Now. Buy and sell Luxury .

0 · Tudor's Maniyar to Spin Off Top

1 · Tudor spinout Maniyar to close quant

2 · Tudor Said to Invest Millions in Bid to Blend Data and Macro

3 · Tudor Jones backs AI hedge funds

4 · TUDOR INVESTMENT CORP ET AL Top 13F Holdings

5 · Paul Tudor Jones, Tudor Investment Holdings

6 · Machine learning in hedge fund investing

7 · Inside the Geeky, Quirky, and Wildly Successful World

8 · Bloomberg Markets: Tudor to Start Macro Fund Using AI

9 · Billionaire Paul Tudor Jones Is Selling Microsoft Stock Hand Over

Xpress Ship. Alexander McQueen Oversized White Black (Women's) Lowest Ask. $363. Xpress Ship. Alexander McQueen Oversized Black. Lowest Ask. $452. Alexander McQueen Oversized Paris Blue. Lowest Ask. $373. Alexander McQueen Oversized Black Shiny Sole. Lowest Ask. $499. Alexander McQueen Oversized White (Women's) .

By some accounts, the company controls a whopping 95% of the machine learning chip market, according to a report released by New Street Research. Paul Tudor Jones, Tudor .

It will be Tudor Investment's only current single-manager macro offering. Maniyar is helping Jones develop new computer models as part of a quantitative revamp of the firm’s . Maniyar Capital, the quant-driven discretionary global macro manager led by former Tudor and Brevan Howard manager Dharmesh Maniyar, will close in October and return .

Veteran manager backs machine learning with investments in CargoMetrics and Numerai.

Dharmesh Maniyar, a top money manager who was tapped by Paul Tudor Jones last year to oversee a macro hedge fund using machine-learning algorithms, plans to spin out . Jones’s firm, Tudor Investment Corp., invested several million dollars late last year in a pair of startups led by entrepreneur Gil Syswerda and has partnered with them to use .Tudor's quantitative strategies utilize statistical arbitrage, credit strategies, volatility strategies, and other strategies focused on futures, foreign exchange, and cryptocurrency. These strategies . In recent years the firm has also launched Two Sigma Ventures, which invests in early-stage companies using data science, machine learning, distributed computing, and advanced hardware across a.

Machine learning investment strategies aim to deliver persistent, uncorrelated alpha streams while adapting to changes in market conditions—without the human input required in . Nvidia dominates the market in both machine learning-- an earlier branch of AI . In the fourth quarter, Tudor Investment more than doubled its Meta Platforms holdings, .

The estimated total pay range for a Quantitative Researcher at Tudor Investment Corporation is 3K–8K per year, which includes base salary and additional pay. The average Quantitative Researcher base salary at Tudor Investment Corporation is 9K per year.

Tudor's Maniyar to Spin Off Top

Tudor spinout Maniyar to close quant

armani original men's cologne

The estimated total pay range for a Software Engineer at Tudor Investment Corporation is 7K–5K per year, which includes base salary and additional pay. The average Software Engineer base salary at Tudor Investment Corporation is 6K per year.Tudor Investment Corporation is an investment adviser that manages client and proprietary assets across various asset classes in the global markets for an international clientele. . include researching and implementing fully automated systematic futures signals and strategies with a heavy emphasis on machine-learning based techniques . The estimated total pay range for a Vice President at Tudor Investment Corporation is 6K–7K per year, which includes base salary and additional pay. The average Vice President base salary at Tudor Investment Corporation is 1K per year.

Tudor Investment Corp ET AL is a hedge fund with 21 clients and discretionary assets under management (AUM) of ,586,929,000 (Form ADV from 2024-03-28). . and cryptocurrency. These strategies rely on technical, fundamental, and other data inputs and may be automated using machine learning techniques. However, the complexity of these . The estimated total pay range for a Intern at Tudor Investment Corporation is 5K–1K per year, which includes base salary and additional pay. The average Intern base salary at Tudor Investment Corporation is 4K per year. The average additional pay is K per year, which could include cash bonus, stock, commission, profit sharing or tips.Tudor Investment Corporation is an investment adviser that manages client and proprietary assets across various asset classes in the global markets for an international clientele. . include researching and implementing fully automated systematic futures signals and strategies with a heavy emphasis on machine-learning based techniques .

Dharmesh Maniyar, a top money manager who was tapped by Paul Tudor Jones last year to oversee a macro hedge fund using machine-learning algorithms, plans to spin out his fund from Tudor Investment . Education: Princeton University

Tudor employs trading strategies across a broad range of securities and derivative instruments in the fixed income, currency, commodity and equity asset classes, on both a long and short basis, for varying investment horizons. Tudor provides discretionary investment advisory services to its Clients, which include the Tudor Funds (some of which .

It will be Tudor Investment's only current single-manager macro offering. Maniyar is helping Jones develop new computer models as part of a quantitative revamp of the firm’s traditional .Tudor’s internship program is structured to provide interns with both a practical hands-on learning experience and exposure to the various functions within a diverse, global macro strategy alternative investment firm. As a Tudor summer intern, you will have a unique opportunity to work at an intersection of investment management, quantitative . Tudor Investment Corp.’s Dharmesh Maniyar posted a 7 percent gain last month in his new fund that uses machine-learning algorithms to help make macro trades.

Our Founder and Chief Investment Officer, Paul Tudor Jones II, is one of the pioneers of the modern-day hedge fund industry. Paul began his career in the cotton pits before forming the Tudor Group in 1980. Paul was eager to create a firm differentiated by a steadfast dedication to client objectives and guided by strong ethics and values. By some accounts, the company controls a whopping 95% of the machine learning chip market, according to a report released by New Street Research. Paul Tudor Jones, Tudor Investment. It will be Tudor Investment's only current single-manager macro offering. Maniyar is helping Jones develop new computer models as part of a quantitative revamp of the firm’s traditional . Maniyar Capital, the quant-driven discretionary global macro manager led by former Tudor and Brevan Howard manager Dharmesh Maniyar, will close in October and return capital to its investors.

Veteran manager backs machine learning with investments in CargoMetrics and Numerai.

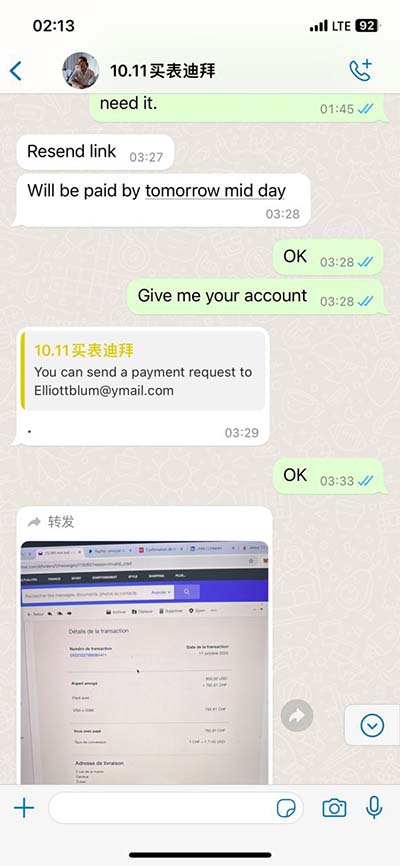

Dharmesh Maniyar, a top money manager who was tapped by Paul Tudor Jones last year to oversee a macro hedge fund using machine-learning algorithms, plans to spin out his fund from Tudor. Jones’s firm, Tudor Investment Corp., invested several million dollars late last year in a pair of startups led by entrepreneur Gil Syswerda and has partnered with them to use machine.

Tudor's quantitative strategies utilize statistical arbitrage, credit strategies, volatility strategies, and other strategies focused on futures, foreign exchange, and cryptocurrency. These strategies rely on technical, fundamental, and other data inputs and . In recent years the firm has also launched Two Sigma Ventures, which invests in early-stage companies using data science, machine learning, distributed computing, and advanced hardware across a.

Machine learning investment strategies aim to deliver persistent, uncorrelated alpha streams while adapting to changes in market conditions—without the human input required in other quantitative investment approaches. Applying machine learning techniques to financial markets is not easy.

armani sport code original

Tudor Said to Invest Millions in Bid to Blend Data and Macro

A selection of signature and experimental double and triple french malt whisky expressions matured in rare cognac casks.

tudor investment machine learning|Paul Tudor Jones, Tudor Investment Holdings