tax refund on lv bags in australia | australian tax office bag deduction tax refund on lv bags in australia It means that if you buy $200 AUD worth of goods from Louis Vuitton, you will not be eligible for GST refund. But if you buy in total $300 USD worth of goods from Louis Vuitton, . To rezerves daļas ir viegli pieejamas, jo Latvijā šis auto ir viens no populārākajiem. Tas nozīmē, ka arī remonta izmaksas nebūs pašas augstākās. Būtiska Volvo priekšrocība ir ekonomija. Vairāki no lietoto auto tirgū esošajiem Volvo spēkratiem no degvielas patēriņa viedokļa būs ļoti labas izvēles.Carbuzz. -. Bojāta prece. Uzņēmums pārdeva auto kuram pēc nobrauktiem 200 km atklājās ātrumkārbas defekts. Sazinājos ar uzņēmumu, bija pretī nākošo iedeva servisa nr. Un apgalvoja kad salabošot. Aizdzinu uz servisu un pēc 3 dienām saņēmu auto tādā pašā stāvoklī. Un uzņēmums uz epastiem vairs neatbild. K Kristaps .

0 · what is the bag tax refund

1 · tax deduction for bags Australia

2 · how much is vat refund uk

3 · does the bag offer a refund

4 · australian taxation office bags

5 · australian tax office baggage claim

6 · australian tax office baggage

7 · australian tax office bag deduction

Capital FM ir radiostacija, kas atrodas Rīgā, Āgenskalnā. Iepriekš Capital FM Rīgā raidīja frekvencē 101,0 MHz, tomēr saistībā ar Radio 101 parādīšanos un šīs frekvences tiesību iegādāšanos, bija uz laiku spiesta pārtraukt darbību. Kopš 2010. gada 24. augusta radio jaunā frekvence ir 94,9 MHz Rīgā, Rīgas rajonā.ESI SVEICINĀTS CAPITAL CLINIC RIGA! CAPITAL CLINIC RIGA ir radīta TEV! Tev, kam vislielākā vērtība ir laiks, kā arī Tava un Tavu tuvinieku veselība. Mūsu klīnikā esam apvienojuši visu, ko sniedz 21. gadsimta iespējas - unikālas tehnoloģijas, lieliskas plānošanas sistēmas, ērtas un pieejamas telpas, kā arī mūžīgās .

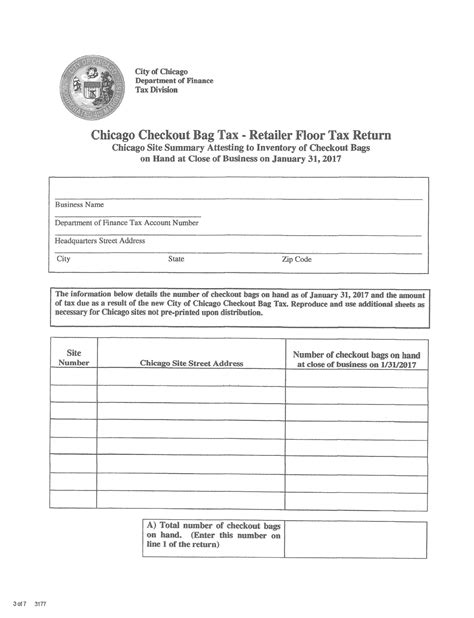

Want to put hundreds of dollars back in to your wallet or purse ahead of your next flight out of Australia? Here’s how to take advantage of the country’s Tourist Refund Scheme . If the bag or case costs under 0, you can claim the deduction immediately on your tax return. To make a claim, you'll need to satisfy four tests:

chanel earrings cheap uk

Bags and cases for work items. Deductions for bags, cases, luggage, lunch boxes and travel mugs you use for work. Last updated 24 June 2024. Print or Download. Eligibility to .you have to apply for the tax refund, but the price of the bags are also generally cheaper (presumably because no extra tariffs are stuff for European bags in Europe). It means that if you buy 0 AUD worth of goods from Louis Vuitton, you will not be eligible for GST refund. But if you buy in total 0 USD worth of goods from Louis Vuitton, .

International travellers (including Australians) might be able to claim a GST (Goods and Services Tax) and WET (Wine Equalisation Tax) refund for some goods bought in Australia that you .

chanel cheaper in dubai

You can claim a GST refund in Australia by lodging a TRS claim through Mobile or Applications. After filling out the claim, you will receive an auto-generated QR code. You still need to present your goods, passport, .Can I write off a Louis Vuitton bag? The basic rule for claiming a handbag or briefcase as a tax deduction is that it must .How to claim a refund. Purchased goods have been made within 60 days of departure. Your purchases is AU0.00 (inc. GST) or more in one store. As the travelling passenger, you . You must leave China from an approved port within 90 days of purchase to receive a refund. Australia. How Much: 10%. Who: Both visitors to and residents of Australia who are leaving the country. Which Stores: Stores require no particular designation from the government in order to sell to customers who will request tax refunds on the goods.

cheap designer handbags chanel

Want to put hundreds of dollars back in to your wallet or purse ahead of your next flight out of Australia? Here’s how to take advantage of the country’s Tourist Refund Scheme or TRS, which lets you claim back the 10% GST sales tax imposed on .

If the bag or case costs under 0, you can claim the deduction immediately on your tax return. To make a claim, you'll need to satisfy four tests: Bags and cases for work items. Deductions for bags, cases, luggage, lunch boxes and travel mugs you use for work. Last updated 24 June 2024. Print or Download. Eligibility to claim bags, cases and luggage. Types of bags and cases you can claim.you have to apply for the tax refund, but the price of the bags are also generally cheaper (presumably because no extra tariffs are stuff for European bags in Europe). It means that if you buy 0 AUD worth of goods from Louis Vuitton, you will not be eligible for GST refund. But if you buy in total 0 USD worth of goods from Louis Vuitton, at one or more of their stores, you can apply for GST refund.

International travellers (including Australians) might be able to claim a GST (Goods and Services Tax) and WET (Wine Equalisation Tax) refund for some goods bought in Australia that you then take out of the country with you on a plane or ship.

You can claim a GST refund in Australia by lodging a TRS claim through Mobile or Applications. After filling out the claim, you will receive an auto-generated QR code. You still need to present your goods, passport, boarding pass, original tax invoices, and the QR code to the TRS Facility.

Can I write off a Louis Vuitton bag? The basic rule for claiming a handbag or briefcase as a tax deduction is that it must be directly connected with producing your income. You can generally claim your handbag or briefcase as a tax deduction if .How to claim a refund. Purchased goods have been made within 60 days of departure. Your purchases is AU0.00 (inc. GST) or more in one store. As the travelling passenger, you have paid for the goods. Present an original copy of the tax invoice to the ABF officers.

what is the bag tax refund

tax deduction for bags Australia

You must leave China from an approved port within 90 days of purchase to receive a refund. Australia. How Much: 10%. Who: Both visitors to and residents of Australia who are leaving the country. Which Stores: Stores require no particular designation from the government in order to sell to customers who will request tax refunds on the goods. Want to put hundreds of dollars back in to your wallet or purse ahead of your next flight out of Australia? Here’s how to take advantage of the country’s Tourist Refund Scheme or TRS, which lets you claim back the 10% GST sales tax imposed on .

If the bag or case costs under 0, you can claim the deduction immediately on your tax return. To make a claim, you'll need to satisfy four tests:

how much is vat refund uk

Bags and cases for work items. Deductions for bags, cases, luggage, lunch boxes and travel mugs you use for work. Last updated 24 June 2024. Print or Download. Eligibility to claim bags, cases and luggage. Types of bags and cases you can claim.you have to apply for the tax refund, but the price of the bags are also generally cheaper (presumably because no extra tariffs are stuff for European bags in Europe). It means that if you buy 0 AUD worth of goods from Louis Vuitton, you will not be eligible for GST refund. But if you buy in total 0 USD worth of goods from Louis Vuitton, at one or more of their stores, you can apply for GST refund.

International travellers (including Australians) might be able to claim a GST (Goods and Services Tax) and WET (Wine Equalisation Tax) refund for some goods bought in Australia that you then take out of the country with you on a plane or ship.

You can claim a GST refund in Australia by lodging a TRS claim through Mobile or Applications. After filling out the claim, you will receive an auto-generated QR code. You still need to present your goods, passport, boarding pass, original tax invoices, and the QR code to the TRS Facility. Can I write off a Louis Vuitton bag? The basic rule for claiming a handbag or briefcase as a tax deduction is that it must be directly connected with producing your income. You can generally claim your handbag or briefcase as a tax deduction if .

chanel perfume cheaper in paris

chanel allure perfume cheap

探索路易威登 Capucines BB: Fashioned from full-grain Taurillon leather, the now-classic Capucines BB handbag displays a host of House signatures: leather-wrapped LV Initials, jewel-like handle mounts inspired by historic trunks, and a distinctive flap with a Monogram Flower motif. Timelessly elegant, this charming model can be carried by hand or worn .

tax refund on lv bags in australia|australian tax office bag deduction