chanel bag tax refund australia | trs refund policy australia chanel bag tax refund australia Here’s how to take advantage of the country’s Tourist Refund Scheme or TRS, which lets you claim back the 10% GST sales tax imposed on almost every product sold in Australia.

FFXIV Ninja Level 70 Job Quest SB - When Clans Collide - Stormblood@ 4:45 Instance, @ 10:17 Battle, @ 25:44 Item Level 290 Gear📌 PLAYLIST Ninja Quests: http.

0 · what is the bag tax refund

1 · trs refund policy australia

2 · does the bag offer a refund

Bonus (Level 50) 120 Allagan Tomestones of Poetics. Bonus (Low Level) Experience, Gil. Bonus Available Daily. Requirement Unlock Any 2 Duties. Total Duties 2. Base Duty Rewards. 20 Allagan Tomestones of Soldiery. Compare Duty Roulette: Main Scenario to other Duty Roulettes.

How Much: 19.6% if processed by the shopper; usually 12% if processed in-store via a refund agency, which takes a cut for itself. Who: Residents of non-EU countries over the age of 16, visiting France on a tourist visa. Which Stores: Stores do not require a special designation to sell to customers looking for a . See moreHow Much: 20% if processed by the shopper; less if processed by the store or an agency hired by the store, who will deduct fees. Who: Residents of non-EU countries visiting the UK on a tourist visa, or EU residents who can prove they’re leaving for at least 12 . See more

How Much: 22% if processed by the shopper; convenience agencies at the airport can quicken and simplify the process, but they will knock your refund down several percentage points with their fees. Who: Non-EU residents visiting the country as temporary . See moreHow Much: 19% if processed by shopper; convenience agencies at the airport can quicken and simplify the process, but they will knock your refund down to around 12% with their fees. Who: . See moreHow Much: 8%. Who: All non-Swiss residents. Which Stores: Stores do not have to receive special government designation to sell to shoppers looking for a VAT refund and most shops (especially high-end fashion retailers or boutiques) in tourist-heavy areas . See more

Here’s how to take advantage of the country’s Tourist Refund Scheme or TRS, which lets you claim back the 10% GST sales tax imposed on almost every product sold in Australia. Australia has a GST refund program, so tourists can claim the tax back at the end of their trip. The GST rate in Australia is now 10%. Who can .

The cheapest place to buy a Chanel bag is in Malaysia. The Chanel Medium Classic Flap Bag is priced at 44,870 MYR with VAT, which is equivalent to ,659 USD. Among all the countries in Asia, Malaysia is the most attractive location for Chanel shopping. Chanel Prices After Tax-Refund

Australia. Shopping in one of the most luxurious cities in the world. How is the experience? . Price Excluding Tax; Chanel New Mini Classic Bag: 60 SGD: 33 SGD: Chanel Mini Square Classic Bag: 50 SGD: 73 SGD: . You can get a tax refund for all your Chanel purchases in Singapore. The VAT rate in Singapore is 7%.CHANEL 19 Bag. See More. Boy Chanel Bag. See More. New This Season. See More. diapositive suivante. diapositive 0; diapositive 1; diapositive 2; diapositive 3; Handbags. Discover the featured creations of the latest collections. Flap Bags. .

what is the bag tax refund

michael kors replica handbags outlet uk

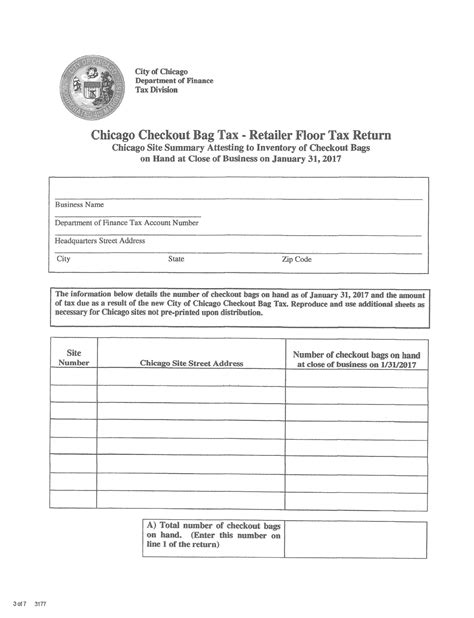

The Tourist Refund Scheme (TRS) allows travellers to claim a 10% rebate on the price paid for almost anything bought in Australia. That 10% is initially paid up front in the form of the broad-based 10% GST (Goods and Services Tax), but when you leave Australia on a flight or cruise you can get that 10% back in full as an Australian GST refund. Chanel Kelly Bag 2023 vs Chanel Kelly Bag 2017. Chanel Kelly Bag 2017 vs Chanel Kelly 2023. On the left, you can see the Chanel Kelly Bag from 2017. On the right, you can see the new Chanel Kelly Bag from 2023. These two handbags are very similar. Chanel named the new bag “Mini Shopping Bag,” but the community decided to call it “The .

The Refund Center: To claim the sales tax back, go to the nearest ‘Refund Center’. The centers are located in different places: The centers are located in different places: Louis Armstrong New Orleans International Airport Main Lobby – Terminal C Opening time: Monday-Friday 8:00 am – 5:00 pm Saturday and Sunday 9:00 am – 3:00 pm Tel .The Real Housewives of Atlanta The Bachelor Sister Wives 90 Day Fiance Wife Swap The Amazing Race Australia Married at First Sight The Real Housewives of Dallas My 600-lb Life Last Week . Plus you will get a tax refund when you return back to the states. . I got a Chanel bag during this recent trip. The tax refund percentage is about 13% . Complete the form and if you have difficulties, then ask the staff for help.“Incomplete tax free form means no tax refund. So make sure all the information are filled in.” 4. Take the original receipts Remember to take the receipts as well.

Price Tax Excluded; Chanel New Mini Classic Bag: 21750 MYR: 20114 MYR: Chanel Mini Square Classic Bag: 20800 MYR: 19235 MYR: Chanel Small Classic Bag: 43020 MYR: 39784 MYR: Chanel M/L Classic Bag: 44870 MYR: 41495 MYR: Chanel Jumbo Classic Bag: 48570 MYR: 44917 MYR: Chanel Maxi Classic Bag: 51470 MYR: 47599 MYR: Chanel . WHAT IS A VAT REFUND? Value Added Tax (VAT) is basically the European Union’s version of sales tax. The standard VAT on retail merchandise in France is 20%, though this tax only applies to EU citizens. . I been dreaming and saving for a Chanel bag for some years now and buying it in Europe would mean so much more. (And save so much more .

miu miu dupe

The Chanel prices in Australia are tax included. You can get tax refund in Australia. The sales tax is 10%. The Australia price of the Chanel Classic Flap Bag listed, is priced without sales tax. Is it cheaper to buy Chanel in Australia? The Chanel Medium Classic Bag costs 710 AUD in Australia, but with tax refund, you can buy it for ,281 .Did you know you can often claim your handbag, laptop bag or briefcase as a tax deduction, if you use it for work-related purposes? . You can do your tax return right now, online, with friendly support. Search. Search this website. Categories. . Etax is Australia's #1 online tax service If you’re going to shop designer bags like Celine, Dior, Louis Vuitton, Chanel or Hermes, make sure you apply. . Guide to tax refund in Australia; Guide to tax refund in China; Guide to tax refund in Japan; . “The Tax Refund Form is valid 2 months from the date of Customs validation.” .Are Chanel Handbags Cheaper in Australia? It depends. Non-Australian fashionistas can benefit from a 10% VAT refund. . The final price with a 5% tax refund is almost the same as the US cost before sales taxes. So if shopping in the UAE, consider saving up to 4-7% (depending on the state you live in). Are Chanel Handbags Cheaper in Dubai .

Shopping designer bags like Chanel, Louis Vuitton or Hermes at Airports are usually the cheapest. . Duty-free at Airport or Tax-refund, which is better? Tax on goods is called VAT in Europe and in Singapore/Australia, it’s called GST. VAT and GST are the same and you can apply for tax-refund if you’re a visitor of that country. Australia. Everyone in Asia loves Japan. It’s not only one of the best holiday destinations, but it’s also known for lower prices on luxury goods. . Price Excluded Tax; Chanel New Mini Classic Bag: ¥693000 JPY: ¥641648 JPY: Chanel Mini Square Classic Bag: ¥663300 JPY: ¥614149 JPY: Chanel Small Classic Bag: . Chanel Tax-Refund in .

At Luxury Reborn, we make it easy to find and buy an authentic pre-owned Chanel bag in Australia. Our range of vintage Chanel bags includes everything from the Chanel pouch bag through to other classic Chanel handbag styles, allowing you to take your style to new heights. Our commitment to quality ensures that all used Chanel bags in our . Chanel M/L Classic Bag: ฿365000 Baht: ฿341275 Baht: Chanel Jumbo Classic Bag: ฿395000 Baht: ฿369325 Baht: Chanel Maxi Classic Bag: ฿419280 Baht: ฿392026 Baht: Chanel 224 Reissue 2.55 Bag: ฿350000 Baht: ฿327250 Baht: Chanel 225 Reissue 2.55 Bag: ฿365000 Baht: ฿341275 Baht: Chanel 226 Reissue 2.55 Bag: ฿395000 Baht: ฿ .Iconic models like the Chanel Classic Flap, the Boy Bag, and the 2.55 Reissue are among the most coveted in the resale market. Chanel Pre-Owned Handbags to Complement Any Outfit. At Royal Bag Spa, we stock a wide range of vintage Chanel bags. From vanity bags to backpacks, each piece offers a unique blend of the brand’s timeless elegance and .

European Union citizens who now live permanently in a non-EU country may access a VAT refund at departure from Italy. How do you get a VAT refund in Italy?³ Receive a tax exemption form. While you are in the store, purchasing your items, you must request a tax exemption form from the seller. Australia. Korea is very famous nowadays, also thanks to k-pop and drama movies. But how about Chanel shopping-spree? . Price Tax Excluded; Chanel New Mini Classic Bag: ₩6620000 WON: ₩6024200 WON: Chanel Mini Square Classic Bag: ₩6340000 WON: . Chanel Tax-Refund in Korea. The tax in Korea is 10%. The Boy Chanel Bag was first introduced in 2012. Back then, the Boy Bags didn’t look like the ones we’ve fallen in love with today. . Tax-Refund Guide; Shopping At Airport Guide; Shopping At Heathrow Airport Guide; Leather Guide; Tech; Chanel Boy Bag. Linh Trang. . Australia: 40 AUD: Japan: ¥580300 JPY: China: ¥44500 CNY: Malaysia . It’s cheaper to buy Chanel in Dubai than in London, assuming you can apply for tax-refund. Since the UK government has abolished the tax-refund scheme, purchasing Chanel goods and bags have become more expensive. The price of the Chanel Medium Classic Bag is 37651 AED (£8080 GBP) Tax excluded. The same Chanel bag is priced at £8530 GBP in .

Chanel M/L Classic Bag: €9700 Euro: €8177 Euro: Chanel Jumbo Classic Bag: €10500 Euro: €8851 Euro: Chanel Maxi Classic Bag: €11150 Euro: €9399 Euro: Chanel 224 Reissue 2.55 Bag: €9300 Euro: €7839 Euro: Chanel 225 Reissue 2.55 Bag: €9700 Euro: €8177 Euro: Chanel 226 Reissue 2.55 Bag: €10500 Euro: €8851 Euro: Chanel 227 .

Price Tax Excluded; Chanel New Mini Classic Bag: €4700 Euros: €3995 Euro: Chanel Mini Square Classic Bag: €4500 Euro: €3825 Euro: Chanel Small Classic Bag: €9300 Euro: €7905 Euro: Chanel M/L Classic Bag: €9700 Euro: €8245 Euro: Chanel Jumbo Classic Bag: €10500 Euro: €8925 Euro: Chanel Maxi Classic Bag: €11150 Euro: €9477 .

Go to the refund kiosk or do this online. I personally prefer the kiosk which is often next to customs. They’ll ask you for which card to receive your refund in. Also: Most refund kiosks have an app where you can sign on and track your refund. You’ll probably get an email when you get your refund forms from the store.

Tax-Refund in Hong Kong. There is no tax-refund in Hong Kong, because the city doesn’t charge VAT, GST or Sales Taxes. All retail prices are final prices. Is it cheaper to buy Chanel in China or Hong Kong? The answer depend on wether you can get tax-refund. In Hong Kong, it’s not possible to apply tax-refund. But it’s possible in China.

trs refund policy australia

miu miu dupe dress

in Shadowbringers. Recommended Videos. Paladin: Speak to Jenlyns over at Ul’dah – Steps of Thal (X: 10.8 Y: 11.1). Must first complete the job quest “Raising the Sword,” the level 80 tank.

chanel bag tax refund australia|trs refund policy australia